Every great business starts with a vision, but visions don’t pay suppliers, salaries, or expansion plans. At some point, every Small and Medium Enterprise (SME) faces the same defining question: How do we grow without giving up control?

The untold reality of underserved businesses…

Access to finance is a cornerstone of economic growth; however, for SMEs, it remains a significant uphill battle. According to the International Monetary Fund paper “Fostering Entrepreneurship and SMEs to Support Economic Diversification in Oman”, in Oman alone, SMEs make up over 98% of all businesses and employ 76% of the private sector workforce. Yet despite driving the economy, they remain underfunded, receiving only about 3.7% of total bank lending. (1)

This is where digital SME finance steps in, designed to close the gap and open the true potential of these businesses.

That mismatch is the funding gap worth billions standing between ambitious businesses and their next stage of growth. For decades, the system was built for big corporations, not agile businesses. Long applications, endless paperwork, and rigid collateral demands slowed growth, drained time, and locked out businesses that deserved to move faster.

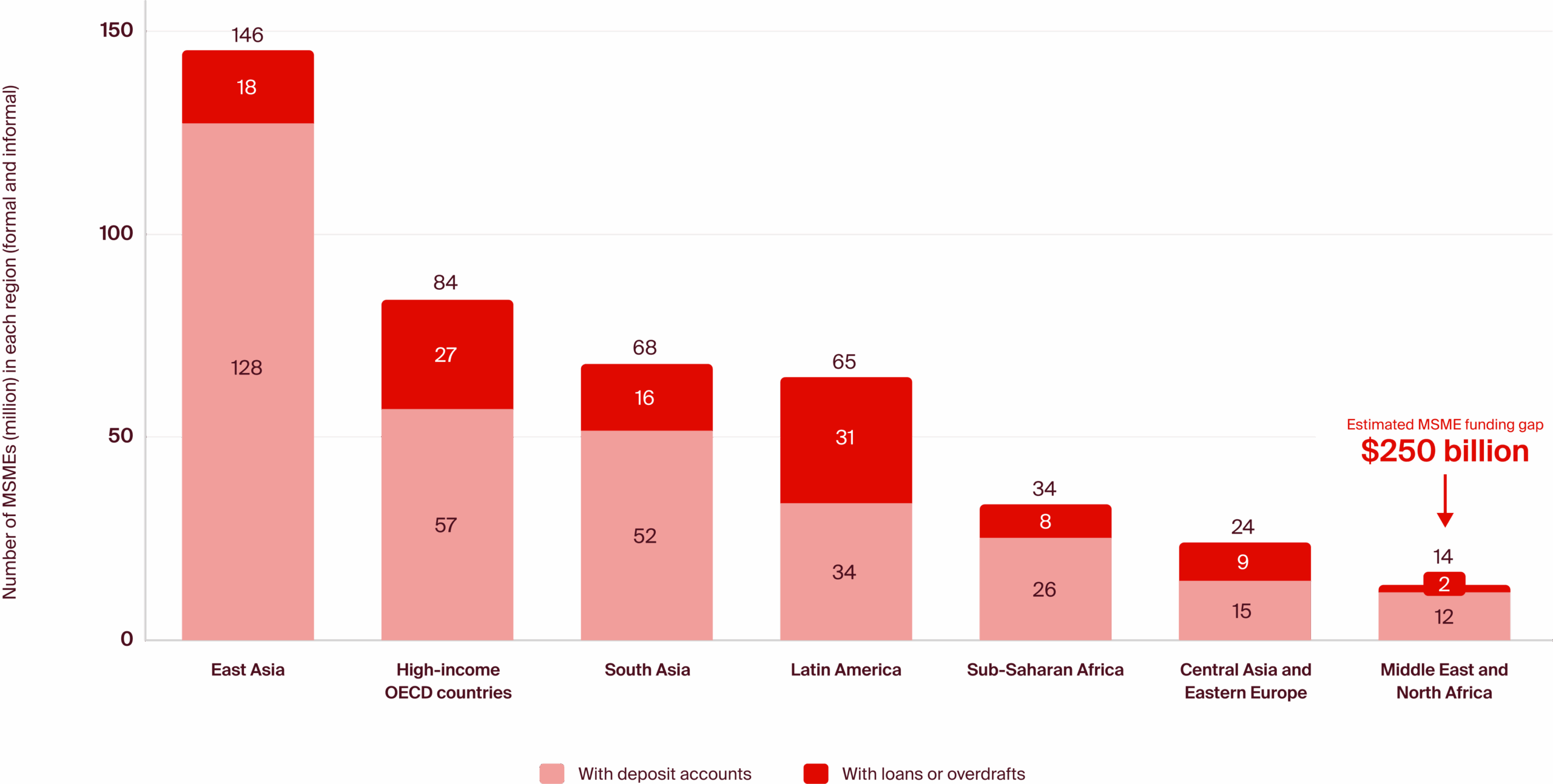

MSMEs represent about 90 percent of businesses and more than 50 percent of employment worldwide

Note: MSME is micro, small, and medium enterprises; OECD is the Organisation for Economic Co-operation and Development.

Source: Kearney research

The shift is already happening

Across the MENA region, that gap is finally being challenged. Estimates place the total unmet demand for SME funding at around $250 billion, with SMEs still managing to secure just 12% of the credit they need, an 88% shortfall.(2)

This isn’t just statistics. Its real businesses stalled mid-stride. Its growth was unrealized. But Oman and other leading economies are no longer waiting for the old system to catch up; they’re embracing digital innovation to bridge the divide.

Our solution to the market

Here’s the good news: business funding does not need to be complicated. The key is finding the type of finance that best suits your business needs.

If your business is scaling, opening new locations, hiring talent, or investing in equipment, you need straightforward growth finance: capital to act on opportunities right now, not six months from now.

Sometimes the challenge isn’t growth, it’s timing. You may be profitable on paper, but cash is locked up, waiting for invoices to clear, while suppliers and salaries can’t wait. That’s where working capital finance steps in. It keeps operations smooth by bridging the gap between money going out and money coming in.

That’s where platforms like Beehive are embedding digital funding directly into the way businesses operate, linking finance to marketplaces and cash-flow systems. This reduces friction, speeds up processes, and gives SMEs quicker access to funds.

Beehive offers a core product that supports bridging the gap. See details in the table below:

| Product | Term Finance |

| Finance Type | Unsecured business finance |

| Amount | From OMR 20,000 |

| Tenor | 12 – 48 Months |

| Funds Transfer | Within 48 hours (once approved) |

| Processing Fees | 5% |

| Profit Rate Range | 7.50% - 9.25% |

| Eligibility |

|

The future is digital

At Beehive, we’re leading this transformation. By leveraging digital SME funding, we’re providing SMEs across the GCC with the capital they need to grow, innovate, and create jobs, thereby contributing to the nation’s Vision 2040 industrial and economic goals.(3)

Digital innovation isn’t just changing funding, it’s redefining opportunity. We’re proud to be at the forefront of building a more equitable and prosperous financial ecosystem for every business in Oman and the GCC.

Explore your funding options with Beehive today and take the first step towards growth. Scale, hire, and invest without the delays of traditional banking.

Terms & Conditions Privacy Policy © 2025 All Rights Reserved.

WhatsApp us