Your partner

in business growth

We help SMEs across the GCC access fast, flexible finance so you

can grow with confidence.

Apply online in minutes

No paperwork. No branch visits. Just a simple online form.

Get funded in days

Quick decisions and faster disbursals so you don't wait.

Transparent terms,

no hidden fees

No surprises. Just straightforward finance.

Funding made simple

Access the funding you need, right when your business needs it.

Start application

Support that scales

with you

Choose the business finance that fits your goals:

quick, simple and made for SMEs.

Explore funding options

Our impact in numbers

From millions in funding to thousands of thriving SMEs, our data tells

the story of growth, trust and transformation across the region*.

0K+

Registered Users

0K+

Funding Requests

0K+

Happy Clients Accross GCC

0%

Client Success Rate

OMR 0M+

In SME Funding

*Group-wide data and figures. Learn more beehive.ae

Why choose us?

Digital first-build for SMEs.

Learn more

Fast & flexible finance

Approvals in days, not weeks.

Digital and hassle-free

No branch visits or heavy paperwork.

Real people, real support

Human support when it counts.

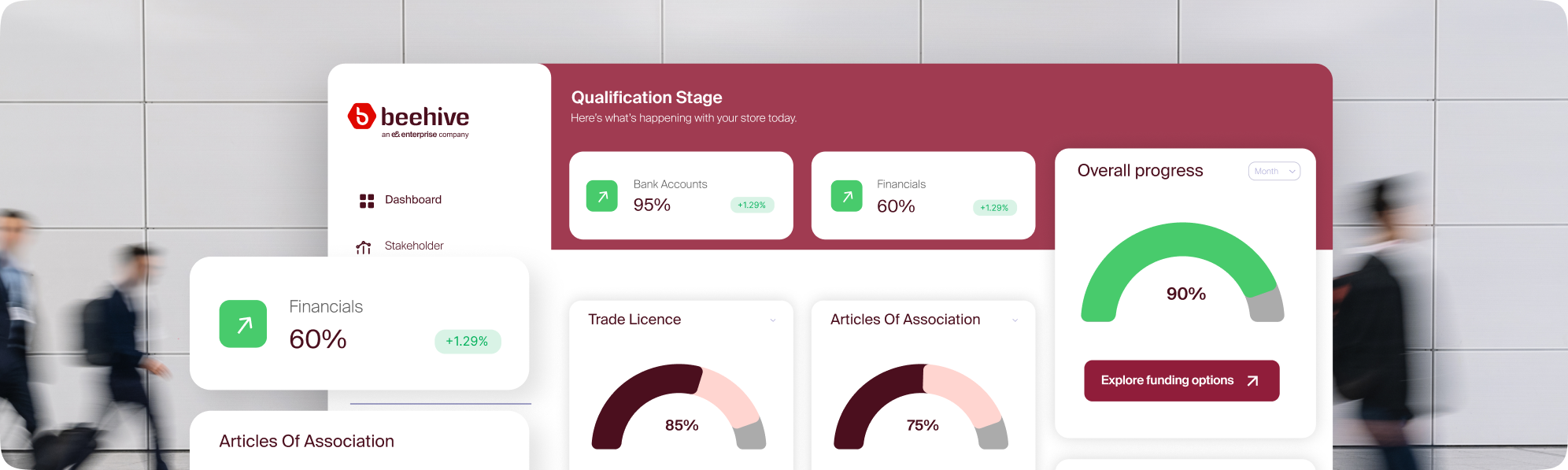

A smarter way

to business growth

Track your applications and manage repayments, all in one place.

Want to invest with us?

A smarter way to invest in SMEs: seamless and built for today's investors.

“Working with Beehive was a reminder that the right partner can make all the difference. They didn’t just provide funding, but also allowed us to focus on our mission.”

Husain Abdulkarim

MD at Discovery Travel

What SME Say

Learn about investing

Our partners