Traditional banking is a growth barrier. Small and medium-sized enterprises (SMEs) are foundational to economic prosperity. But according to the World Bank Group, a financing gap of $5.2 trillion threatens 65 million SMEs worldwide1.

The situation is especially bleak in the Middle East and North Africa (MENA), where 88% struggle to access financing1. Half of those cannot access it at all. When credit-hungry enterprises don’t have a seat at the table, economic fatigue takes hold.

An Economic Linchpin

The Problem of Financial Gatekeeping

Traditional banks cling to rigid, slow, and outdated lending practices. The application process alone can overwhelm SMEs with limited resources. Funding can take weeks to months, making it difficult for businesses to compete effectively.

Adding insult to injury, traditional banks often snub SMEs in favour of established corporations. Smaller businesses are riskier and their lower credit needs just aren’t profitable. This leads to frequent loan rejections, creating one of the largest financing gaps in the world.

Economic prosperity in the Middle East hinges on a thriving SME sector. According to the IMF, improving SME financial inclusion to the average level of other emerging economies would increase annual economic growth by up to 1% and create roughly 8 million jobs by 20252.

The Case for Disruption

Peer-to-peer (P2P) lending platforms are disrupting the traditional banking industry with alternative financing solutions. Their unique draw? Speed, efficiency, and inclusivity.

Beehive, for example, can fund a loan within 30 days. This is significantly faster than traditional banks due to their extensive documentation requirements. A lighter administrative burden allows for rapid turnaround so SMEs can address financial needs and seize opportunities faster.

Beehive’s digital platform streamlines the application process, reduces the administrative burden, and evaluates the person behind the business – not just their credit score.

Surviving the Central Banks

This inclusivity is especially critical in a high-interest-rate environment. When the US Federal Reserve adjusts its rates, most Gulf central banks respond in kind because their currencies are pegged to the US dollar. Since 2020, interest rates in MENA have more than tripled3. As a result, debt has become more expensive and harder to access. This poses an existential threat to SMEs.

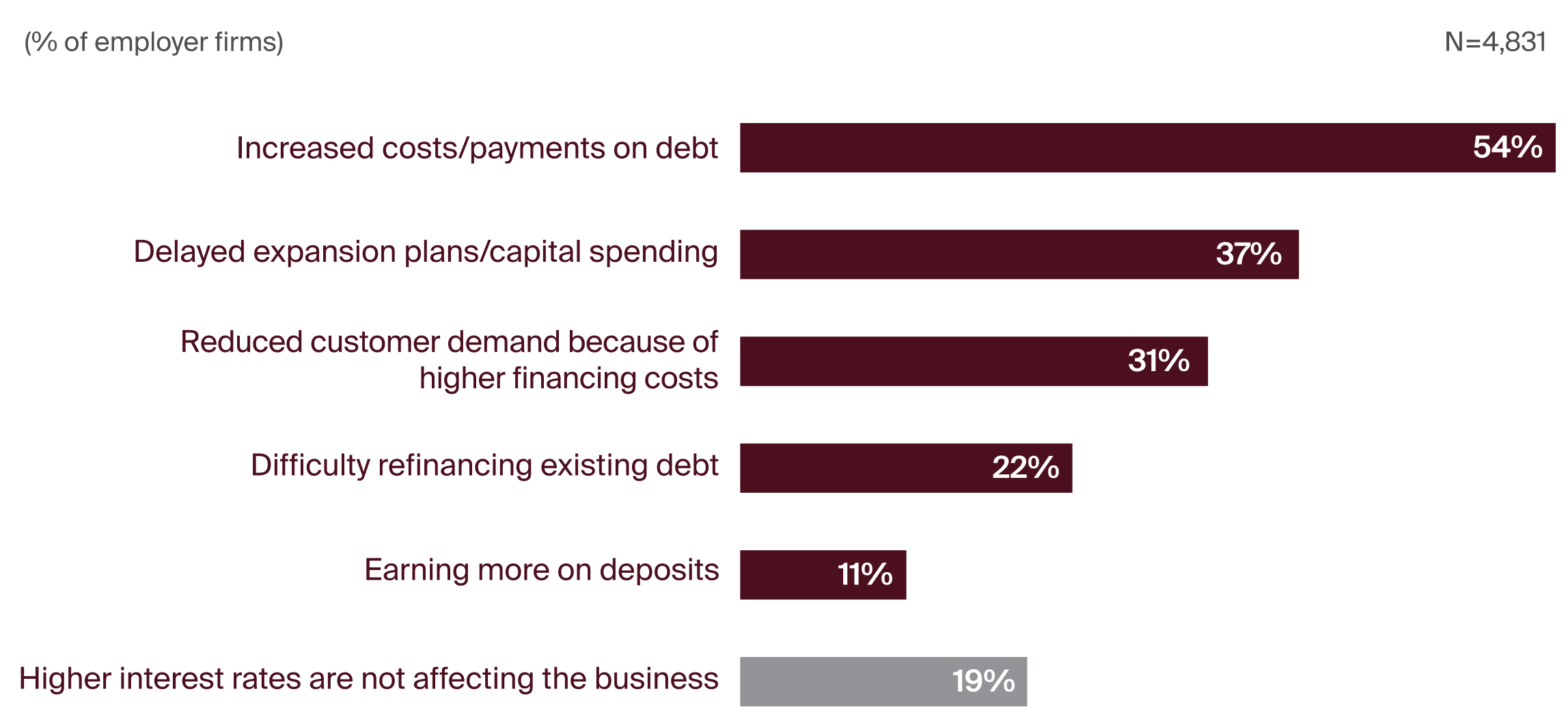

A 2023 Small Business Survey in the US revealed that 54% of respondents are experiencing higher debt payments resulting from higher interest rates, with 37% delaying business expansion. Currently, business loan applications have the second-highest rejection rate4.

Effects of higher interest rates

The Winning Play: Connecting Businesses with Investors

P2P lending is at the forefront of a well-overdue financial revolution, with the market poised to hit USD 1.1 trillion by 20336. This type of private credit breaks barriers by connecting SMEs directly with a diverse pool of investors and eliminates the need for expensive and sluggish intermediaries.

And the benefits are twofold. First, it provides SMEs with faster, easier access to financing with lower rates and flexible terms. Second, it provides lucrative investment opportunities outside the traditional financial system. Investors can diversify their portfolios and capture higher returns compared to traditional investment products.

Fast Funding Breeds Success: Beehive’s Impact in MENA

Beehive is the first regulated peer-to-peer (P2P) lending platform in MENA, providing SMEs with alternative, inclusive, and fast financing options. Since inception, the company has funded over 28,000 financing requests from 1,500 businesses. To date, Beehive has helped SMEs access over AED 2.5 billion.

Enerwhere: Quick Crowdfunding for Expansion

Enerwhere, a Dubai-based solar company, struggled to access affordable traditional bank financing. “The only offers we saw from banks were double-digit interest rates, which is unattractive,” recalls Daniel Zywietz, CEO of Enerwhere.

So, he turned to Beehive, where the company raised AED 1 million in less than seven days and secured a significantly lower rate compared to traditional bank loans. Beehive’s innovative 14-day reverse auction system lets investors compete to fund a company’s financial request, substantially reducing borrowing costs.

“We had the money in the bank 2 days after the auction closed,” said Zyweitz, “it was successful and we believe we can raise more this way.” Beehive provided fast, effective funding that helped Enerwhere expand its operations with solar hybrid power generators and rooftop systems.

Oliv: Accelerating Growth with Fast Funding

Oliv is a career platform that connects students and graduates with relevant job opportunities. The CEO, Jean-Michel Gauthier praised Beehive stating, “The funding process was simple and straightforward, taking just a few weeks from start to finish.”

The company used the money to grow its business development and marketing teams with five new hires. As a result, Oilv saw 50% growth month over month. Beehive’s funding provided a critical financial runway that allowed Oliv to tolerate higher-risk business decisions for higher returns.

“Raising with them has allowed us to execute our growth plans ahead of schedule,” explains Gauthier. With Beehive’s help, Oliv experienced accelerated growth with the financial support it needed to execute its strategy quickly.

Filling the Funding Void

Traditional banking poses significant challenges for SMEs, especially in the MENA regions where the financing gap is a major growth barrier. Their outdated processes are risky business. Beehive offers a powerful alternative with its innovative P2P lending platform. You can secure fast funding, often within 30 days, and enjoy lower interest rates. Visit Beehive today and thrive with quick and easy financing options you won’t get anywhere else.

Key Takeaways

Past performance is not necessarily a reliable indicator of future results.

References

1World Bank. “Small and Medium Enterprises (SMEs) Finance: Improving SMEs’ access to finance and finding innovative solutions to unlock sources of capital.” World Bank Group. 2019. https://www.worldbank.org/en/topic/smefinance

2Nicolas Blancher et al. “Financial Inclusion of Small and Medium-Sized Enterprises in the Middle East and Central Asia.” International Monetary Fund. 2019. https://www.imf.org/-/media/Files/Publications/DP/2019/English/FISFMECAEA.ashx

3FocusEconomics. “Policy Interest Rate (%).” FocusEconomics. 2024, https://www.focus-economics.com/economic-indicator/policy-interest-rate/

4“2024 Report on Employer Firms: Findings from the 2023 Small Business Credit Survey.” Small Business Credit Survey. Federal Reserve Banks, March 7, 2024. https://doi.org/10.55350/sbcs-20240307

5Thomas Kroen, Troy Matheson, and Thomas Piontek. “Higher Interest Rates Testing Banks in Middle East, North Africa, and Pakistan.” International Monetary Fund, December 14, 2023. https://www.imf.org/en/Blogs/Articles/2023/12/14/higher-interest-rates-testing-banks-in-middle-east-north-africa-and-pakistan

6Precedence Research. “Peer to Peer (P2P) Lending Market Size to Hit USD 1,168.1 Bn by 2033.” Precedence Research. March, 2024. https://www.precedenceresearch.com/peer-to-peer-lending-market

Terms & Conditions Privacy Policy © 2025 All Rights Reserved.

WhatsApp us